Here are the best ways to decide if your house would make a good rental property

Have you ever considered becoming a landlord? Wondering if it would be profitable to rent out your own house or maybe buy one specifically in order to rent it out? Well we’ve done just that. We rented out our first ever home! In this post I’ll show you how and why we did it, how we determined if it would be profitable, and what to consider if you are thinking about renting out your house.

Is It A Good Idea to Rent Out Your Home?

When my husband took a new job in Charlotte, we knew we had to say goodbye to living in our little house in Raleigh, NC. It was bittersweet, as this was the first home my husband and I had ever bought, we loved it, and had lived here for over 7 years.

Also it was such an intimidating thought, putting our house up for rent having never been landlords before. But after doing a lot of reading, talking to a property management company or two, and knowing what I know as a real estate agent, we felt confident we could do it!

Deciding If It’s Worth It To Rent Your House Out

So the first step is determining if it’s going to be profitable to rent out your house. The last thing you want to do is lose money every month! There are a few factors to think about when determining this.

The biggest one you’ll need to consider is what is your monthly mortgage payment (if you have one) versus what is the monthly rent you’ll bring in. You will also need to think about repairs, the property manager fee (if you choose to have one), vacant months, taxes, and insurance.

I know that might sound like a lot, but there are some great resources out there that can help you determine those average numbers. I’ll get into more about those below

Potential Rental Property By the Numbers

As a general rule of thumb, you want to aim to receive 1% of the home’s value in rent each month. For example, if the house costs $150,000, you should hopefully obtain $1500 a month in rent for it.

Now, that’s not always possible in certain areas, so it’s best to consult a property manager or real estate agent to determine what properties are renting for in the neighborhood. Alternatively, the calculator over at Rentometer will also give you a free estimate.

For the other expenses, 5% is an average expected cost for vacancies. This means if you are getting $1500 a month for 12 months, you should subtract 5% for those months if/when it’s between tenants. In this example that would be $900 for the year.

Repairs are difficult to predict, but try to think of the condition of your systems when calculating this. We are aiming to save up 2% of the home’s value per year for repairs. Taxes and insurance are included in our mortgage, but our homeowner’s insurance did go up by about 20% when adding on the “landlord policy”.

Should You Use A Property Management Company?

I knew we wanted a property management company for our rental house right from the beginning. Because I am a licensed real estate agent, there are special rules for me as a landlord in North Carolina. They have to do with where and how we handle the tenant’s security deposit, how it’s marketed, and how we receive the rental income.

I didn’t want the extra responsibility of maintaining the required accounts and paperwork myself, so I chose to have the property management company step in. They were an excellent resource for rent values in the local area and they take care of all of the tenant-facing interactions.

If you decide to have a property manager, shop around for the best rates. It’s very common for them to charge the first month’s rent as well as fees of up to 10% a month. For us, that’s worth it but your situation may be different.

Other Posts About Real Estate You May Like:

- How To Choose An Awesome Real Estate Agent

- Reach Financial Independence and Retire Early

- How We Hit the House Jackpot and Gained Over $100,000 in Equity

Calculate If Your House is Profitable As A Rental

So, you have your property, you have a general idea of the numbers, now you need to see if this will work. Luckily for us all there is a website that is an invaluable resource for just this sort of thing: Biggerpockets.

This is such an incredible place, I really can’t say enough awesome things about it. In this post today I’m going to use it for their fantastic rental property calculator, but they have so much more. Seriously, when you have some time, go check it out.

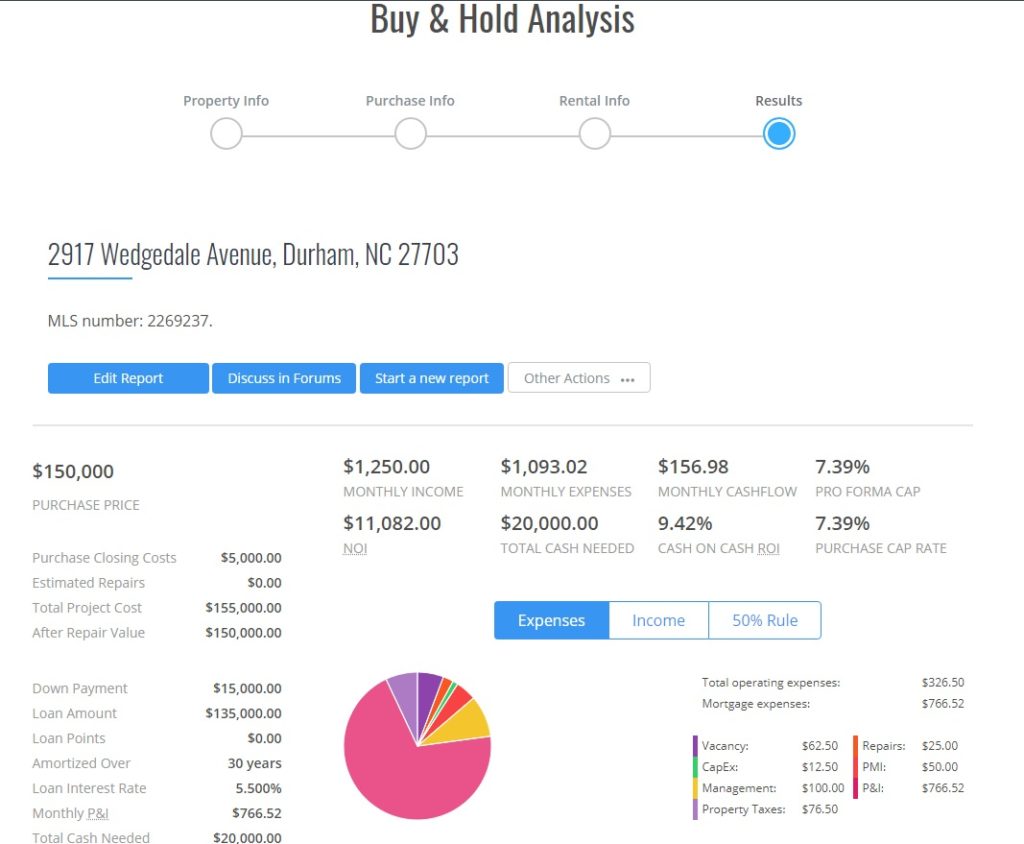

Using the Bigger Pockets Rental Property Calculator, which is free for the first 5 times you use it, you can put in the details of your property and it will come back with all the numbers you need to help you decide if renting it will make you enough money or not. Lets look at my example below:

Analyze Your House as A Rental

I generated this report for free, on a sample property I found for sale, and based on some estimates I entered. I tried to use numbers that would be about average for a house priced in this range. But of course, it’s all subject to your market. Remember, when you go to turn your own house into a rental, your numbers will depend on what your mortgage payment already is so you can use those numbers.

Now, depending on your situation, the above may or may not be a great deal. That 9.42% listed as the “Cash on Cash ROI” is generally considered a decent return, with most investors agreeing 8-12% is the target. The cap rate of 7.39% is also about average, with 4-12% being a typical range.

But what’s probably going to make or break it for most people is that $156.98 in monthly cashflow. (This was with an 8% property management fee. If you choose to do it yourself, add 8% of the monthly rent back to this number.)

So is that enough of a return each month for you to keep your property as a rental? Well that will be up to you, but at least with this tool you can get an idea of the kind of numbers you would be considering.

Should You Consider Purchasing A Rental Property?

By now you may have also thought about purchasing a house to rent out, instead of converting your own home to a rental. Of course, this calculator is also perfect for that. You can simply do the analysis on a property you find, and see if the estimated numbers would work out in your favor. The key thing to remember is the tool can only give you a good estimate if you have accurate numbers, so do your research!

Final Thoughts On Renting Out Your House

Everyone’s situation will be different, but I hope this serves as a guide on what to consider when you are thinking about renting out your house. If it’s profitable, it could be a very good investment for your future income. Knowing which numbers to look at and which numbers are ideal is half the battle.

So what’s your market like? Are you seeing good opportunity for renting or for buying? Let me know in the comments!

Related Money and Investing Articles:

- Givling: The Trivia App That Pays Off Debt

- Use Credit Card Rewards to Travel for Free

- Get Started Micro Investing with These Apps

Leave a Reply