Achieve financial freedom by living below your means so you can stop working or work when and where you want

If you’re interested in living a life you love without financial obligations forcing you to work a job you hate, this is the post for you. Here we’re going to look at why you should pursue FIRE (Financial Independence Retire Early) and how to reach it.

There’s a weird cultural attitude here in the States and many other developed nations, where most people think it’s normal to have to spend the majority of your life working because you have to for money. And we’re not talking the purposeful, soul fulfilling job that you do-because-you-love-it kind of work here either.

This is the mind-numbing, boss is terrible, have to do it to feed myself/family kind of slog that takes up the majority of the week. And also, apparently, most of us hate it. This attitude that it’s normal and financial independence is too good to be true and that it’s impossible to retire early seems to be held by the overwhelming majority somehow.

So why is this crazy notion just considered how it is? Are we just doomed to be miserable for most of our time here? Well I think so many folks just fall into this way of life and don’t know how to get out or even realize that they could get out.

There’s lots of blame to go around, no doubt, from capitalism to the school system to just plain human nature. But at the risk of sounding a little bit like a cult leader, I’ve got some fantastic news for you:

IT DOESN’T HAVE TO BE THIS WAY

Saving and Investing Wisely Can Lead to Financial Independence

What if I told you that thanks to the magic of the modern age (the free flow of information) that you could make decisions about your spending which could change your life and give you the freedom to pursue whatever is that you really want to be doing?

How about if I said with just some consistent dedication for a relatively short amount of time you could secure your financial future for the rest of your life. And that you can do it all simply with your own knowledge and the right mindset? You’d probably tell me I’m ridiculous, if you’re even still reading!

But if you have read this far, congratulations! You just might be able to pull this off.

Articles Related to Saving Money:

- Environmentally Friendly Ways to Save Money

- Budgeting for Beginners

- Why Sinking Funds Are Necessary to Your Budget

Financial Freedom all comes down to this:

It’s not about what you SPEND, it’s about what you SAVE.

I’ve talked a little about this before with micro investing, but it is just so important that I’m going to mention it again. Saving money in investments is the secret sauce to reach financial independence and retire early from mandatory work forever.

Why? Because of the magic of compound interest. Over time, the money you invest grows on itself, exponentially. Meaning that once it gets to a certain point it starts to grow out of control. In a very good way. The money you’ve saved starts producing more money for you. Perpetually. And it’s shocking how relatively fast your money begins working for you.

The 4% Rule of Investments for Retirement

When invested properly, as in a low-fee index fund like the Vanguard Total Stock Market Index Fund, you are essentially investing in a small piece of a bunch of the best American businesses all at once. Some go up and some go down but because there are so many, it’s mainly just the the overall U.S. economy, and so it averages out to about 7% in interest gains a year.

And that is a very conservative estimate. So every year, you are basically given about 7% of the total amount you have invested. You can choose to reinvest that (which you should do while you’re saving up) or you can take it, leaving the balance of what you have invested alone to do the same for you the following year. This can eventually become your income and the permanent replacement for that terrible job you have.

Now, a caveat to this is that each year the value of the dollar increases about 2-3% in inflation. Which becomes a problem if you’re taking out the earned interest every year (which is the goal remember) and only leaving your invested amount to grow.

7% of $500,000 is still $35,000 whether it’s 1989 or 2019, but $35,000 can’t buy you in 2019 what it could in 1989. So to be on the extra safe side, some people smarter than me at investopedia say to plan on just taking out 4% of your returns and leaving the rest to continue growing. This leaves you with an ultra ultra reserved estimate of how much you need banked to be totally set for life.

Calculate Your Financial Freedom with the Rule of 25

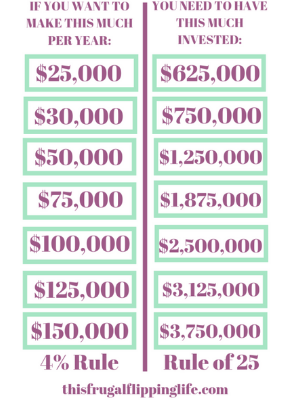

The second part of the 4% rule is the rule of 25, which is what you use to figure out how much you need in order to retire early and just be able to take out the 4%. It’s the annual income salary you want times 25. Here’s a handy example chart:

Okay But Over A Million Dollars for Retirement?? How Would I Ever Get There?

You may be asking this, because it sounds like a lot, and it is! But the way you do it (and you CAN do it) is the other ingredient to that secret sauce that lets you retire early. Your savings rate.

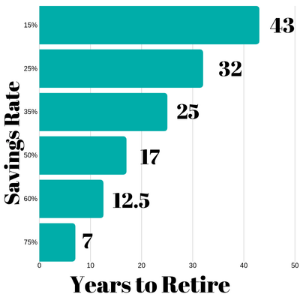

Yes, some very smart financial advisers recommend an extremely respectable savings rate of 15%. Okay, sure. That’s fine if you want to always have to be working for 43 years and retire when you’re older like most people. But the point I’m trying to make with this post is that you DON’T have to be like most people! Spending the majority of your days stuck in an unavoidable rat race is not your only option.

The math is pretty clear – if you want to save up enough money so that it produces this livable income for you, you buckle down and save a large portion of your income. We’re talking 50%, 60%, even 75% of every dollar you make gets invested. The higher percentage, the less time you have to do it. Does a decade seem like a fair trade off in order to live all the remaining decades of your life in freedom? It definitely does to me!

What You Need to Save to Retire Early

I know this is something that most of the population considers impossible and crazy but just look around you. The $20,000 car you bought at 4.5% interest for 5 years is actually costing you closer to $25,000 with yearly maintenance, gas, registration, and taxes.

The nice apartment you pay $1500 a month for by yourself isn’t building you any equity, yet still manages to take $18,000 away from you every year. Your weekly workday lunches ($8), your fancy morning coffee ($5), and your too-tired-to-cook dinners ($12) mean you’re throwing away about $6,000 a year on convenient food!

I’m not saying to forego everything you love and live in a box. Just consider re-evaluating what you currently deem as “necessary luxuries”. Are they potentially the lifelong shackles that hold you down to mandatory work? Living with intention, even for a relatively short time, could catapult you into ongoing prosperity if you try. This great quote from Dave Ramsey says it really well:

“If you will make the sacrifices now that most people aren’t willing to make, later on you will be able to live as those folks will never be able to live.”

Financial Independence Costs Less Than You Think

Once you start being more mindful about both what actually makes you happy and what you spend your money on, I can guarantee you will find that you really don’t need to make as much as you thought. Living in a paid off house, with a modest car that doesn’t have to sit in traffic burning gas for 1-2 hours a day, and making fresh meals at home because you had time to prepare and enjoy them is all surprisingly cheap!

Achieve FIRE – Financial Independence Retire Early

I don’t know about you but I find all this news incredible. It changes my perspective on just about everything. The connotations around “retire early” seem to usually be either denial or dislike. As in, “Why would I want to sit around and do nothing all the time? It sounds boring.”

But what I’m trying to convey is not that you should stop “working”. It’s that you shouldn’t have to spend so much of your life being forced to do work you don’t enjoy, just because you have to do it to pay your bills. You should be able to “work” on or in things that you really care about. Things that inspire you.

Whatever it is that you want to be doing, whenever you want to be doing it. How much more amazing would the world be if more of us got to do that? To me, that is worth doing everything I can to get there, and trying every day to achieve it.

Other Posts about Frugal Living You May Like:

- Alternative Products to Save Money and the Planet

- A Routine for the Best Frugal Skincare

- Pay Off Your Debt with this Free Trivia App

WOW this is a great post! Very informative on how you can retire and live comfortably at an early age!

Thanks Holly! I really believe anyone can do it with focus and determination!

Great advice! It is so important!

Thank you!! 🙂

I love this. I’ve been looking into changes that we can make so that we don’t have to retire at the “normal” age. I’d rather go on my adventures while I’m young!

That is awesome! It’s amazing how some simple changes really add up too.

This is fantastic advice, and I have lived it and continue to live it. I have also made the mistake of sticking with a job that made me miserable for too many years. Really great advice. I hope lots of young people will heed it!

Yes!! Thank you, that is my hope too!

My husband just retired but he’s 14 years older than me so I need these tips!

wow. great information!

Thank you for this awesome information. I am a huge Dave Ramsey fan so I always enjoy reading about becoming financially independent.

Great post! I have recently made some changes to try to get out of the “stick with a miserable job to feed your children” norm.

Life is much too short to be miserable. I happen to like my job, a lot, but I still have a goal of retiring early. My company has a 401K and a pension, which is unheard of in this day and age. I max both out and we have a generous company match. We also have an excellent stock plan. I also made sure we did not overextend ourselves with our home, cars, etc. A lot of people in my field (I am an attorney), live quite large. Vacation is one expense and I will not give that up. Now, if only college was free. LOL! Excellent article. Thanks for sharing your tips and thoughts.

Really great strategy! I really appreciate you sharing this information. And very happy that I read it now 🙂

Great tips. The best advice I got for savings or investing, was anytime you get a raise that money should be set aside.

Our goal as a family is to be able to retire early. I wish we started investing earlier than we did but at least we started. You have great information here, thanks for sharing.

This is very informative! Thanks for sharing.

Wonderful advice! I still have things that need to change, but I love the realistic reminder that it IS possible!!!

Great information. My husband retired last year and I will this year (early for me) because we followed this advice many years ago!

I love this! This an inspiring post to get to saving more. Definitely a great goal to work towards.

Life IS too short! I was fortunate enough to create passive income so I do not have to work. Best thing we ever did. Great tips!

As we get closer to retirement we wish we had started much earlier! I hope younger people read this and take it to heart!

Great info. I wish I had learned these principles as a young adult. As a 61 year old my house and car are paid for. I don’t have debt. But I don’t have a large savings account either! Everything I do now is to help my kids as they raise families of their own and travel! The biggest change I’ve made in the last few years is one you mention. I prepare meals at home. Huge savings there over eating out frequently.

I keep telling my boys this – save early, save often. Great summary!

The key is to start early too. The earlier you start, the longer time the money has to multiply! Great post!

This is great information! I think that it can be so daunting if no plan is created and then followed. But with any journey, if you have a good roadmap, the trip seems less daunting.

This is some interesting and valuable information. Saving this link so I I can refer to it when Hubby and I discuss finances again.

WOW, great post! Very informative I love how you break things down and make it doable! Thanks for sharing 🤗

This is very really unique helpful information. keep it up. Thank you so much!

Thank you Martina! I’m glad to hear you found it useful!