Use this monthly bill tracker to keep up with your finances for free on Google Sheets

You know you need a budget. You know that to set one up, you’ll first need to know how much money is going out each month. So before you begin setting goals and restrictions on yourself, take a month or three and track your expenses.

Taking a look at this Budget For Beginners, you’ll see that it’s most important to start keeping a record of your re-occuring bills. The best way to do this is with a monthly expense tracker.

Where can you find one of those you might ask? Well, it just so happens that I’ve created a my own spreadsheet in Google Sheets for this exact purpose! You see, I had this same need to track my bills for my own budgeting desires.

But, I just couldn’t find one that did exactly what I needed without a whole lot of extra distracting or confusing stuff. So I took the time to develop a simple one. I’ve adjusted and tweaked it over the years to be just what I need to provide a clear, concise picture of my monthly bills at a glance.

Other Articles Regarding Saving Money:

- Ways You Can Go Green and Still Be Frugal

- Micro-Investing Apps for Beginners

- How We Cut Our Food Budget In Half

What is the Free Monthly Expense Tracker?

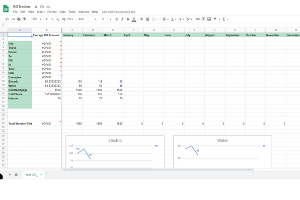

This spreadsheet has the first left-hand column (A) that is customizable to your bills. I added some examples of what you can use near the bottom of this column and across a few of the columns.

Column B will automatically figure out the average of that bill according to the numbers you input in the other columns. You don’t have to adjust this, it will change as you fill in your bills. It’s just there to help you figure out how much to allocate for that bill based on the average history of what it has been.

Then as you go across, each column is a new month, with the total displayed at the bottom.

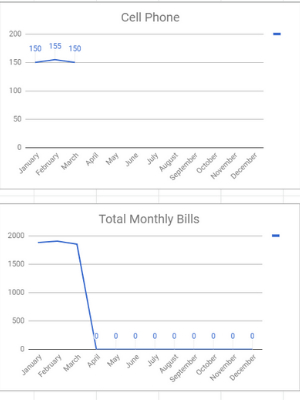

Under that, there are these graphs like above that are linked to each bill slot. They will automatically adjust depending on the numbers you enter. This makes it easier to see your long term trends. Also, even though it defaults to January, you can change the column headings to start whenever you choose.

How to Use A Monthly Expense Tracker

I love having information simply displayed like in the graphs above. They allows me to quickly see how I’m doing for the month, and project what future months will look like. I usually pre-fill my fixed amount bills ahead of time and then just fill the ones that fluctuate monthly.

Having the total for the month then helps me estimate what needs to come from each of my paychecks to fund my bill paying account. What’s a bill paying account you ask? I explain more about that in the second half of this post about How to Make A Budget for Beginners.

If you’d like a link to this free tool, add your email to the box below and I’ll send it to you. It’s a Google Sheets file, so if you don’t have a Google account just let me know and I can send you an MS Office file instead.

Why Do You Need A Monthly Expense Tracker?

Other than all of these perfect reasons listed here by The Balance, as mentioned before using some kind of record keeping method can help you tremendously when you are trying to create a budget for yourself. If you don’t know what’s coming in and what’s going out you’ll never gain control.

Try out this method for a few months and see what you think, because I promise you some places your money goes will surprise you. I hope you will find this monthly expense tracker as useful as I have when working on your budget. Happy planning!

Related Posts about Frugal Living

- Inexpensive or Free Hobbies

- Travel Cheaply or For Free with Credit Card Rewards

- Alternative Products for Saving Money and Saving the Environment

Leave a Reply