What is Micro-investing and How Does it Work? Beginner Apps to Start Saving

Have you ever heard of Micro Investing? Now that we live in the future, technology allows us to do our banking pretty much anywhere and everywhere. And most importantly, you can now start your investing profile with very little money.

This ease of access has opened up a whole new way of how we manage our money. Enter the micro investing app. These apps allow you to put away a small amount (think less than a dollar in some cases) into an investment fund. Gone are the days of unreachable-to-the-average-person $5,000 minimum “starting” investments. Now anyone can get a jumpstart into the world of investing.

Why Invest with Micro-Investing Apps?

Before discussing the options, I should mention a little about why it’s so important to invest your money at all. And to do it sooner rather than later.

If you are saving money in a savings account or under a mattress, you aren’t getting anywhere close to maximizing it’s growth potential. In fact, you might actually be losing money over time!

That’s because when inflation is higher than the interest that is gaining in your savings account, you can buy less and less with the same dollar in your account with every passing year. And the interest in your savings account is often less than (according to gobankingrates.com) or just barely keeping up with the rate of inflation.

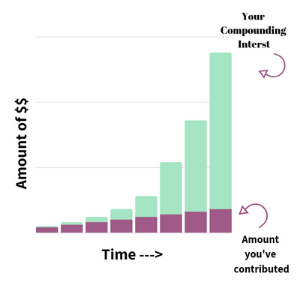

But the good news is, not only can you counteract this, but you can also grow your money to multiple times it’s value by investing. This is done by the magical power of compound interest.

And the real power lies in how much time you can leave it in there to grow under that compounding interest. I won’t go into too much detail about this now, but if you want to read more about this incredible concept you should check out this excellent FREE course from Smart About Money.

Articles Related to Saving Money You Might Also enjoy:

- Be Eco-Friendly AND Frugal with these Swaps

- Cut Your Monthly Food Costs by Doing This

- Why Your Budget Needs Sinking Funds to Survive

How Does Micro Investing Work?

Traditional investing would require you to put down a larger sum (often starting at $5,000) to open an account and have it managed by a broker. You then had to pay that brokerage high fees to do that managing.

Also, stocks in large companies are often hundreds of dollars a piece. So as you can see, if you were going to open an investing account and start buying even a few handfuls of stocks you’d need thousands of dollars to get started.

Maybe it’s just me, but I don’t know too many folks with just extra thousands on hand to play around with. Because let’s not forget the risk factor. Anytime you invest there is a chance you could lose some or all of your investment.

Now, if investing appropriately, that chance of loosing money is very low but things do happen – businesses go under, lose money, etc. So, the more you pay in, the more that potential loss can sting.

But with micro investing however, you don’t have to risk a lot upfront. These companies don’t have as much overhead as traditional brokerages, so they end up costing you less to manage your account.

They also have MUCH lower account minimums as well, meaning you can easily get started with way less. Some even work by rounding up the change when you make purchases and putting that difference into an investing account. The idea here is that you set aside money to invest without even noticing it, and minimize your risk while you’re at it too.

*This post contains affiliate links which means I may receive compensation at no extra cost to you if you click on them.*

Sofi – The Best Microinvesting App (in my opinion!)

Not just a student loan refi company! Sofi offers a wide range of financial services, one of which is commission free investing. With an easy to set up account you can quickly link your bank account and start buying stocks.

You’ll have tons of resources at your fingertips, from how to get started with the basics to advanced investing strategies. You can set up automatic investments – by share OR dollar amounts, with no trading fees. Crypto currencies are also offered. Check it out here: Sofi Investing.

An Easy Micro-Investing App: Stockpile

Stockpile will also let you open an account for just $5, but there is no fee or minimum balance required. Every time you buy a stock, or a fraction of one, through Stockpile it’s $0.99.

The Most Convenient Micro Investing App: Acorns

Acorns is one that you can set to round up your change every time you buy something and then turn around and invest it for you. With $5 you can get started and there’s a $1 monthly fee.

There is also a 0.5% management fee, but they do have an excellent range of portfolios by risk tolerance. Not sure what you want your risk to be? They will help you decide.

Another Great Micro-Investing App: Robinhood

The Robinhood app has no trading/commission fees, and you don’t have to pay a fee for account management either. Going along with that, they don’t offer much in the way of investing advice, but it’s simple design is very easy to use.

Microinvesting Plus Advising: Wealthfront

Wealthfront offers the benefit of advanced software to help you decide how to invest. They often refer to this as a “robo-advisor”. That’s because the software is doing the things that a human broker would normally do. This allows them to charge much lower fees – 0.25% annually with no minimums and no trading fees.

A Versatile Investing App: Clink

As with many of the others on this list, you can open an account with $5 on Clink. It also has a $1 monthly fee for balances under $5,000.

How to Get Started with Micro Investing for Beginners

All of these apps will essentially help you do the same thing: just start. You probably won’t become a millionaire by just putting aside your spare change, BUT the important takeaway is that once you get the ball rolling you can then move it over into larger investment plans and start to really increase your contributions when you’re ready.

Time is the key factor when investing so the earlier you can get started doing something the better off you’ll be.

Other Posts Related to Frugal Finance:

- Frugal Alternatives for Everyday Living

- Pay Off Debt By Playing this Free Trivia Game

- Try This Frugal Skincare Routine

Leave a Reply