Starting A Budget for Beginners – Create a Budget from Scratch

How to make a budget is one of the most important things everyone should know how to do. I don’t know why they don’t teach this in Adulting Class in school. What’s that? There isn’t an Adulting Class in school?? Well, it’s a good thing I’m here then. 🙂

In this post I’d like to show you how to make a budget from the very beginning and the system that I personally use to keep our bills and financial goals on track. And why should you keep a budget you ask?

According to Investopedia, keeping a budget helps you save for the things you want, handle emergencies, and leads to you being happier in your retirement years. You have nothing to lose and everything to gain, so let’s go!

Where To Start When Creating a Budget

So really all a budget is, is a plan that tells your money where to go each month. That’s it! Not that scary. In order to set one though, you first have to know what your expenses are, which means you need to record them somewhere.

Take at least a month and keep track of all that you spend on bills, food, gas, and other necessities. You can do this by writing it all down or you can link your bank account to a tracking app. I like to use Mint for this but any ol’ spreadsheet will do!

At the end of the month (or months) you’ll be able to see what your spending categories are. Don’t get discouraged here, you have to know where you are in order to improve. That’s why you’re doing it to begin with, right?

Budgeting for Beginners: Sorting Expenses

So now that you’ve got some idea of where your money is going, it’s time to divide that into categories.

Ongoing Bills

First and most important will be your recurring or ongoing expenses, like utility service bills, debt payments, rent or mortgage, etc. Also in this category ideally is what you’re putting away in savings, but don’t worry if you aren’t saving yet. That’s partly why we’re making a budget in the first place.

Ongoing expenses are mostly fixed amounts but they can also vary slightly, like the electric. Either way, you’ll want to give yourself a buffer in how much you’ll set aside for them. It would be best if you can take a look at a bill over the previous year, find the average amount as well as the highest amount and choose a buffer somewhere in between.

For example, our water bill averages around $52 but it has gone up to $68 in the past. (You can find this on most utilities websites, they keep track of your bills even if you don’t!) So for this example I would set aside $65 every month just to be on the safe side.

I do this with all of my bills, including rounding up fixed amounts. Netflix was around $11 and some change every month, so I would just put $15 in for that. And now that it’s gone up to $13 a month it hurts less! Bonus!

I’ve made a useful spreadsheet for just this purpose that will help you estimate averages and keep track of your recurring bills.

Discretionary

So after grouping ongoing expenses, next you’ll move on to more discretionary expenses. Now, I think of these really in two subcategories. In this first semi-discretionary section you have things like food and gas. These are things that you have to have at some minimum level but just how high or low is mostly up to you.

The second subcategory is completely discretionary, like trips to the movie theater. I suppose you could argue that entertainment is also necessary at a minimum level as are other things like travel but we’ll get to that.

For now, just define your semi-discretionary expenses as things you regularly need that aren’t in fixed amounts, and aren’t part of the monthly utilities or service bills above.

Other Posts Related to budgeting and Saving Money:

- Save Money in Your Budget (And Save the Planet Too!)

- Sinking Funds: Why Your Budget Will Fail Without Them

Determining Your Budget

Once you have totals from your ongoing expenses and semi-discretionary expenses, subtract them from your income. You can either spend or save the amount left over. Are you finding that it’s not as much as you would like?

Then take a look at your other categories and it should be much easier now to see what can be changed. Maybe it’s time to drop your gym membership that you never use. Want to set yourself a savings goal? Cancel your cable and that magazine subscription you never have time to read and move that amount into what you want to save instead.

Or maybe you are blown away that you and your husband alone spent $1400 on food in ONE MONTH. Yes, we really did.

Seeing what you are spending and setting goals/budgets for yourself are the first steps to making a change for the better. You might not get it exactly perfect the next month but the beauty is that you can then re-adjust it again for the next month.

Controlling the Flow of Cash in Your Savings

Okay. You’ve seen what the numbers are, you’ve determined what they can be, now what? You need a system that structures your budget and keeps the balance between what is coming in and what is going out.

It’s also helpful when you can take a glance and see just how much you currently have and how much you’re spending on anything at one time.

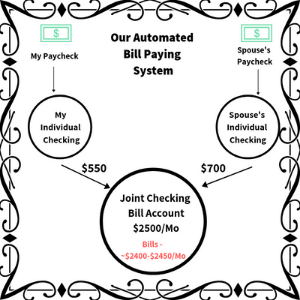

What I’ve found works best for us is a system that goes like this: 3 bank checking accounts. A personal one for me, one for my husband, and a joint checking account. We each receive our paychecks into our individual checking accounts. However…

Every payday we both move over a predetermined amount to cover bills into our joint account. All of our ongoing bills come out of this joint account throughout the month, and we are each left with our individual accounts to handle things like food, gas, and other random stuff that comes up in daily life.

The predetermined amount for the bill account comes from the averages plus buffers that I figured out above when I was talking about how to make a budget. I total up all of our ongoing expenses, including that small buffer for each, and then figure out how much we both should move over every payday.

Basic Budget Example

I’ve figured out we need around $2500 a month to cover all of our bills comfortably. That’s with about $50-$100 included as a buffer. We each are paid twice a month, and if we set everything as equal it means we’d both have to move $625 every payday into our joint account.

But, my husband currently makes more than I do, and he really wanted a more expensive car. It came with a higher payment, so we’ve worked it out that he puts in $700 and I put in $550 each payday.

This has fluctuated over the years, as our bills and income change. Overall this system works well for us. We each get to keep our own accounts and have control over most of our spending with the most of the bills always being covered.

This budget system worked for me when I was single too. I had one checking account that was just for bills and one for everything else.

Note about beginning a budget:

The joint bill account NEEDS to have some money in there to start. Remember, you won’t always be paid at the same time your bills are due. It’s designed so that you’ll keep a continuous rolling balance.

As the account grows, that buffer will get larger. You can then leave it there for emergencies or “scoop out” some of the excess to spend or save.

Once you feel comfortable in your balance you could set your bills to autopay from this account. I find this extremely helpful. Everything gets paid on time and I don’t have to constantly remember to do it. Usually I just check in with my account every few days to make sure things are still running smoothly.

Conclusion to Starting a Budget System

I realize my method may not be for everyone, as you need to have some cash upfront to get it started. Timing is really important too. You need to know that you have enough in your account for things to come out as they should.

However, I wanted to share this with you as a bill pay system that’s useful for us. Even with the time it takes to make a budget and keep up with it, it would take even more time to go in and pay each of my bills individually every month.

Once, a co-worker told me she still went to the power company’s office EVERY MONTH to hand deliver her payment. She didn’t do online banking and didn’t trust the mail. O_o My head almost exploded at the thought of putting that much time and effort into stuff like that regularly. It’s the 21st century! Embrace the convenience!

Anyway, regardless of how you do it, setting up a budget is crucial. It will help you reach goals in your financial life. I’d love to hear about your budget and what system works best for you, so let me know!

Leave a Reply