What to Look For in A House that will Grow Equity

There are many ways to build home equity but buying a house can still feel like a gamble when you don’t know what you’re doing. It was definitely like that with our first house, which is why it felt just like hitting a house jackpot when it turned out like it did.

So I wanted to share this story with you in the hopes that you can take the “luckiest” factors and recreate them for your advantage. I’ll point out what to look for in the market, in the neighborhood, and in the house itself so you can shift the odds more in your favor.

Home Equity Building Tip #1: Choosing a Location

Everyone always says location is important, right? But what exactly is it about location that’s so special? When it comes to value, proximity is what matters. How close is it to a major retail development? Is it by a beach? Are there any industrial power plants around? This is one of the most important factors when it comes to current and future value.

You can increase your chances of a rising property value by choosing somewhere that will grow. A nice shopping area with higher end stores, a movie theater, and restaurants all within 5 to 10 miles is ideal. You’re not going to see property values skyrocket anytime soon if there aren’t signs of life anywhere within a 20 minute drive.

Growing Home Equity: Timing

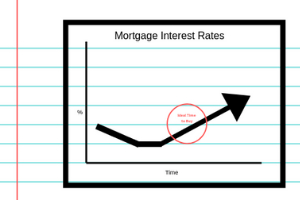

Okay obviously this one is a lot harder to work with, but if you can use it to your advantage it’s incredible. The market has natural ups and downs, and we just happened to buy as the market was climbing out of one of the largest downs in history. The main point here is not to buy when it’s going down but when it’s on the way back up.

From 2009-2011 the market had pretty much bottomed out. However in 2012 mortgage interest rates started trending upward and that is a signal to go in.

True, 2011 would have been best with what turned out to be the lowest rates but at the time no one knew if the economy would continue to recover from there or if it would struggle along for a few more years. So 2012 was perfect in that it still had very low rates but was trending upward, signaling a recovering economy.

Related Articles for First Time Homebuyers:

Build Your Home Equity By Leveraging Mortgage Products

There are many types of mortgages and programs to use to your advantage so do your research. Going back to location a bit, we found a house that was eligible for USDA loan financing.

It has many advantages like a 0% downpayment and low mortgage insurance fees. The USDA loan also determines a property’s eligibility by how “rural” it is. They only redraw the map every 10 years. You can really take advantage of an area’s previous growth by buying in the last year before they redraw it.

Our property’s location exploded in the previous decade so we were able to really maximize the benefit of this loan. I credit our excellent lender for teaching us all of this, which is just another reason to go with a local, primary market lender, not one of the national big name or secondary market lenders.

Bankrate has some solid advice here regarding building your equity with a large downpayment as well, so look into that if it’s something that might be doable for you.

Building Home Equity: Repayment Options

Paying your mortgage a certain way can really help in the long run. We make half of our mortgage payment every two weeks instead of the full payment monthly. If your mortgage will allow this, go for it!

This results in one full extra payment each year, which means the balance is paid quicker and with less interest. Yet it doesn’t feel like you are paying more. And speaking of paying more…

We round up our payment to the nearest hundred. It still doesn’t feel like that much, yet contributes just that little extra anyway. And with the way interest works, any amount that you can pay earlier becomes exponentially cheaper for you over the lifetime of the loan.

Summary of the Best Ways for Growing Home Equity

In a nutshell these were the main factors that played the biggest role in how we hit the house jackpot:

- Choosing a location that’s rural enough for USDA, but close enough to major retail development to increase future property value

- Buying when the market was down but going back up steadily

- Getting a loan that required low upfront investment

- Repaying in a way that maximizes extra dollars on principle

In a little over 8 years now we’ve built over $130,000 in equity with our first house. We started with NO downpayment and paying very little extra each month. You can do it too!

I hope this helped to highlight some methods for buying a house that will grow in value. If you have any other ways of gaining equity quickly I’d love to hear them!

Leave a Reply