6 Painless Tips to Beat Frugal Fatigue and Meet Your Financial Goals

Hey Frugalites! Today I’m very excited to introduce a guest post by author Mia Jones. She’s put together this excellent article I’ve shared below, which addresses a common roadblock we all face at one point or another on our finance journey: Frugal Fatigue. To learn more about what this is and how to overcome it, read on!

“Without frugality none can be rich, and with it very few would be poor.”

-Samuel Johnson

Frugality can be a pain in the butt when you pinch pennies for every occasion and restrict yourself from all the enjoyments in life.

What Do You Mean by Frugal Fatigue?

When you feel tired, exhausted, and stressed out due to pinching pennies, it’s called frugal fatigue. Usually, it happens when you deny yourself of all the pleasures of life simply because you want to save money or get out of debt. Extreme frugality leads to frugal fatigue, and that is not good.

Other Posts Related to Saving Money:

- Travel Hacking with Credit Card Rewards

- How We Cut Our monthly Food bill in Half

- How to Save money and the Planet

How Do You Know You’re Suffering from Frugal Fatigue?

It’s true that frugality can be a great way to knock off credit card debt. But the constant effort to lead a humble lifestyle can be tiring. It can lead to frugal fatigue. Here are a few signs to know if you’re experiencing frugal fatigue.

- You’re unable to live in peace due to constant money worries.

- You end up spending recklessly one day after getting frustrated.

- You’re not happy after embracing frugality.

- You get frustrated when your family members spend money on things that you consider as unreasonable.

- You just don’t care about your money or financial matters. You’re completely fed up.

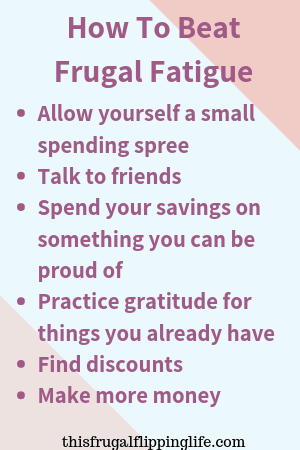

How to Beat Frugal Fatigue When You’re Tired of Saving Money

Tired of pinching pennies and being financially responsible? Here’s what you can do to fight off frugal fatigue.

1. Go for a small spending spree

Go ahead and spend dollars on things that make you happy. If you’re eyeing a particular shade of lipstick for a long time, go ahead and buy it. You deserve to have little fun. Remember that little adage, “all work and no play makes Jack a nerd.” I’m sure you don’t want to be something like that.

2. Speak to your buddies

Speak to a frugal friend and discuss your problem with her. Vent out your frustrations and negative emotions to a frugal friend. Perhaps, she can give you a good solution to this problem.

3. Use your savings for a good purpose

You have done a lot of hard work. You’ve sacrificed a lot of things. You have saved a lot of money. Now, it’s time to use the money for a good purpose. If you owe money to creditors, then use your savings to consolidate your unsecured bills into an affordable monthly payment plan. This would give a sense of relief. You’ll realize that your months’ of hard work have paid off.

4. Look at what you have and appreciate

There must be a reason why you’re leading a frugal life. Think about that reason. Have you embraced frugality for giving a good education to your child? In that case, you should feel proud. You have a beautiful child to take care of. Not many people have a child. In fact, many people have less than you.

Appreciate the good things in your life before they are gone. This might include:

- A caring family

- A partner who loves you unconditionally

- Loyal friends whom you can call at 2 am

- A home where you can live comfortably

- A collection of fantastic books to read

- Good health and career

Focus on the beautiful things you have. Feel privileged and be grateful to God instead of complaining about what you don’t have. Many people would be ready to give up many things just to get what you have.

5. Watch out for the discounts

Who told you that you can’t visit amusement parks or eat good foods when you have embraced frugality? Watch out for discount passes to amusement parks. You can also subscribe to a deal website for grabbing great deals on food, shopping, entertainment, concerts, etc.

Wait for the free museum days and free meals at restaurants. Take your kids to museums and restaurants on those days. They will love you even more.

6. Make more money

There is yet another way to overcome frugal fatigue. Get a side hustle and make more money. This would help you save dollars without sacrificing your lifestyle. You can do freelancing or a part-time job to boost your income.

Use the extra cash for paying back your bills, buying an apartment, and building your nest-egg.

Concluding Ways to Beat Frugal Fatigue

Frugal fatigue is bound to happen when you’re too strict upon yourself. It’s something like a diet. When you starve until you get frustrated, you feel like splurging on whatever you see. That’s normal.

Even when you’re dieting, there is something called cheat day when you’re allowed to eat whatever you want. Likewise, when you’re suffering from frugal fatigue, take a break and enjoy small splurges. Create a special category in your budget plan called ‘splurge fund.’ Allocate some money to this category every month so that you can have some fun and continue with your frugal life.

Are you suffering from frugal fatigue? What steps have you taken to deal with it? Do you have any suggestion for our readers? Feel free to share your suggestions and queries down below.

Author bio: Mia is a freelance writer. Traveling and writing are her passions, and she uses articles as a platform to share her vivid experiences. She explores various topics on personal finance, frugal living, minimalism, etc. in her creative endeavors. Her mission is to help others find ways towards a healthier financial life. If you would like to contact Mia she can be reached at emailmia692@gmail.com.

Great post! I totally agree with give yourself a small spending spree and giving into that small item that you had your heart set on! Great points on getting a side hustle for extra cash because money can help towards bills.